Navigate Vancouver Island’s Real Estate with a Proven eXpert

Your journey to the perfect home on Vancouver Island starts now. With an extensive knowledge of the market and a genuine love for our community, I’m more than just a REALTOR ®; I’m your guide, advocate, and steadfast ally in this exciting process. Whether you’re buying or selling, my aim is to ensure a seamless and rewarding experience, reinforced by the trust and recognition that comes from being a people’s choice in real estate.

Client Satisfaction Speaks Volumes

Moreover, heartfelt testimonials from satisfied clients underscore the trust and confidence placed in my services, while numerous five-star reviews showcase the quality you can expect. As a result, you’ll receive service that is straightforward, honest, and deeply client-focused.

From Current Listings to Completed Sales

Browse my curated collection of homes for sale that I’m currently representing and those I’ve successfully sold. Each listing is a promise of possibility, and every completed sale is a testament to my personalized service and client satisfaction. It’s not just about transactions—it’s about matching dreams with doorsteps on Vancouver Island.

Unlock the Treasures of Living on Vancouver Island

Venture through the diverse landscapes of Vancouver Island with my curated guide. From tranquil coastal havens to bustling city retreats, uncover a world of possibilities for your next home.

MLS Map Search Experience

Master your property search with my dynamic MLS Map Search tool. As your dedicated eXpert in buying and selling, I understand the importance of context and detail in real estate. Buyers can delve into neighbourhoods of their choosing with visual maps, showcasing real-time listings near essential amenities like parks, schools, and local conveniences. Meanwhile, sellers and buyers both gain a competitive edge by analyzing sold prices from the past two years, pinpointing the market value within desired locales. Navigate with confidence and clarity to find your perfect property, informed by sold prices and tailored neighbourhood insights.

Featured Property Types for You

Explore a selection of properties, from peaceful waterfront retreats to welcoming family houses, each with the potential to be your next home. It’s about discovering the perfect place that resonates with you. As your dedicated buyer’s agent, I’ll guide you to a home where living where you love becomes your reality.

Find Upcoming Open Houses in Your Area!

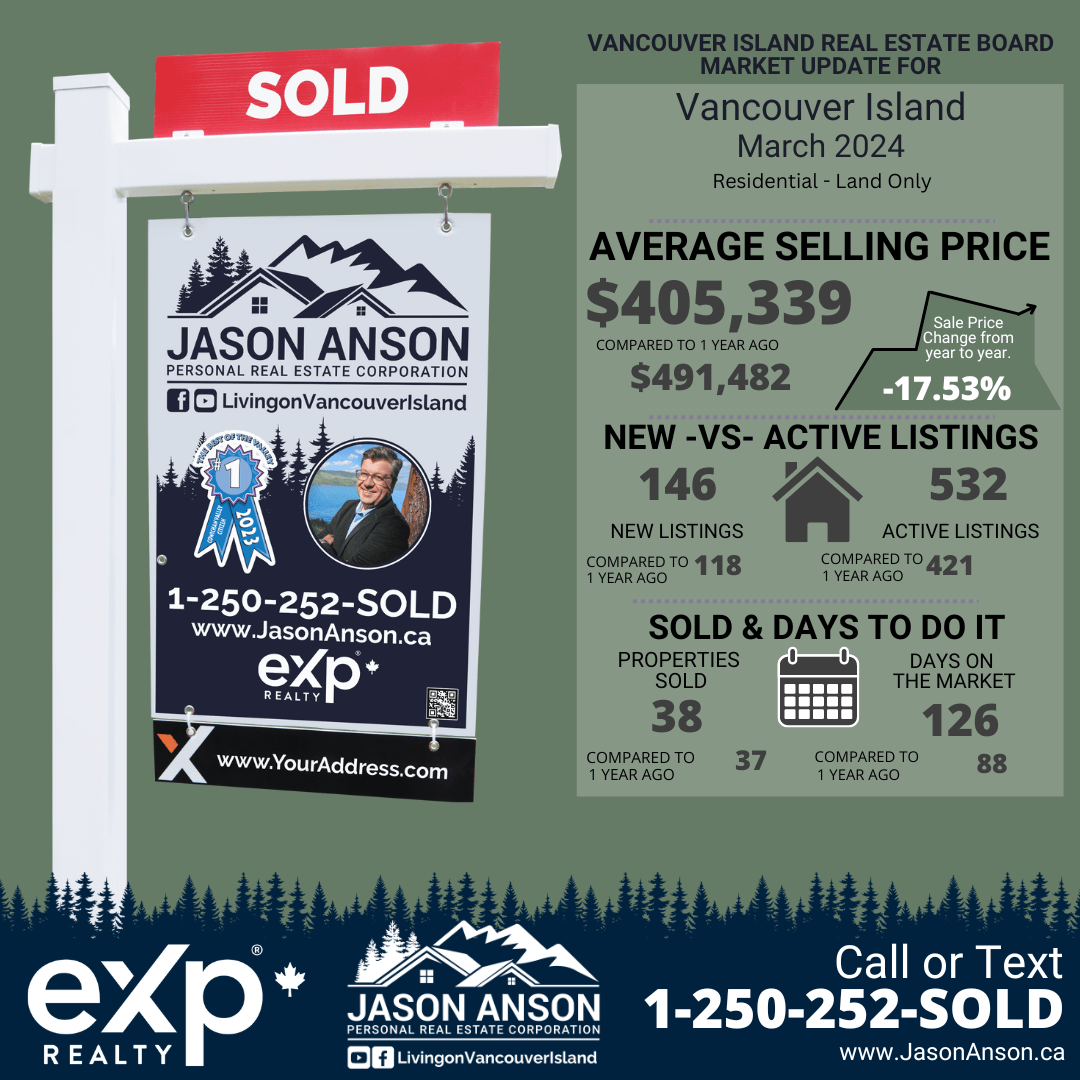

Vancouver Island Real Estate Market Reports

My monthly real estate market reports are compiled using data from the Vancouver Island Real Estate Board, which provides detailed information on everything from current prices and sales volume to inventory levels and market conditions. As a real estate agent, I will help you analyze this market data, enabling you to make informed decisions about when and where to buy or sell on Vancouver Island. Click here to contact me to discuss your real estate needs.

eXpert Buyers’ Tips Video to Smart Home Purchasing

Gain an edge in the housing market with my exclusive video with eXpert buyers’ tips. Designed to steer you through the complexities of purchasing a home.

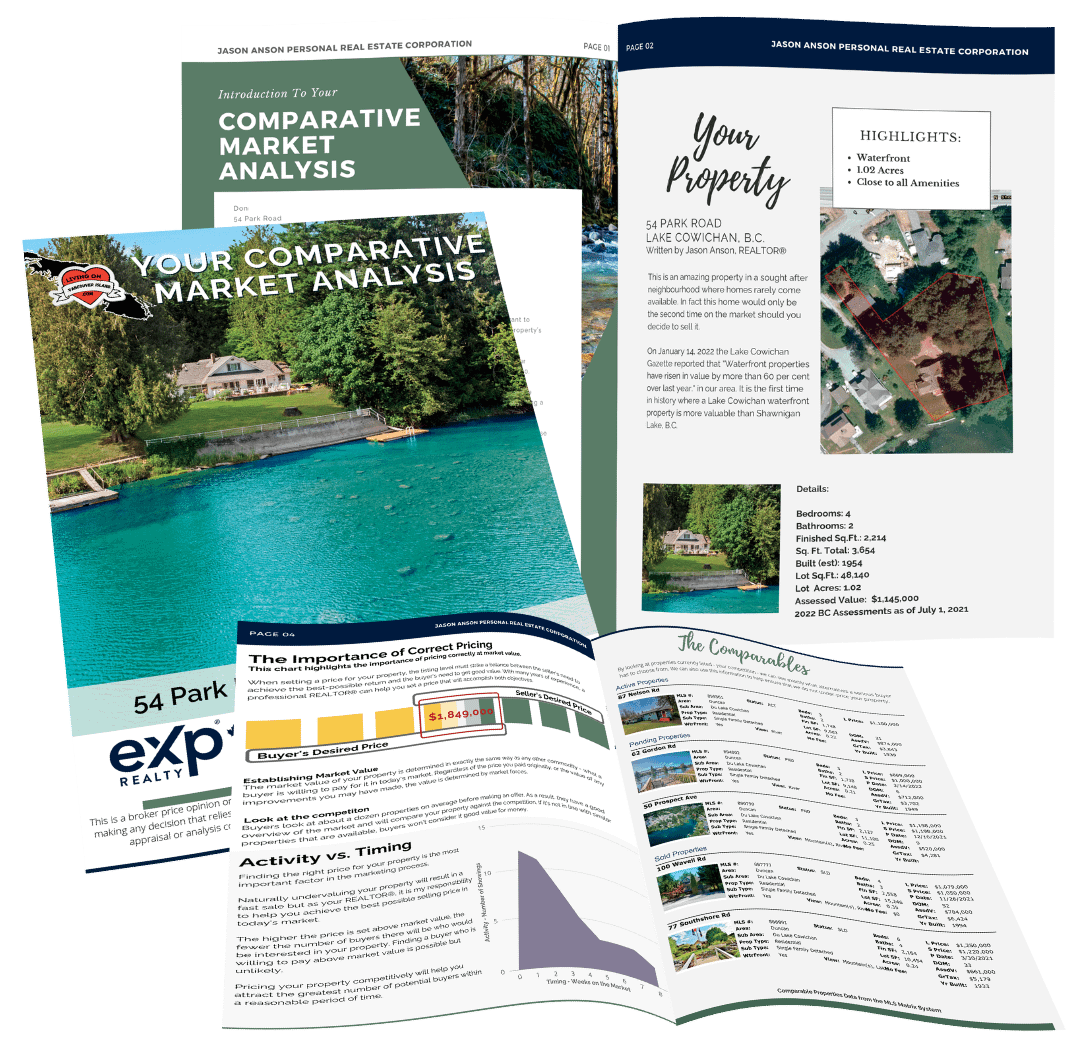

Unlock Your Home’s True Value – Get a FREE, Detailed Market Analysis Now!

Navigate Your Home Sale with Assurance. Discover the Value of Your Home in Today’s Dynamic Market by Entering Your Address Below.